Dr Biplab Pal ( bpal@robolytics.ai/biplabpal20000@gmail.com)

Dr Biplab Pal ( bpal@robolytics.ai/biplabpal20000@gmail.com)

___________________

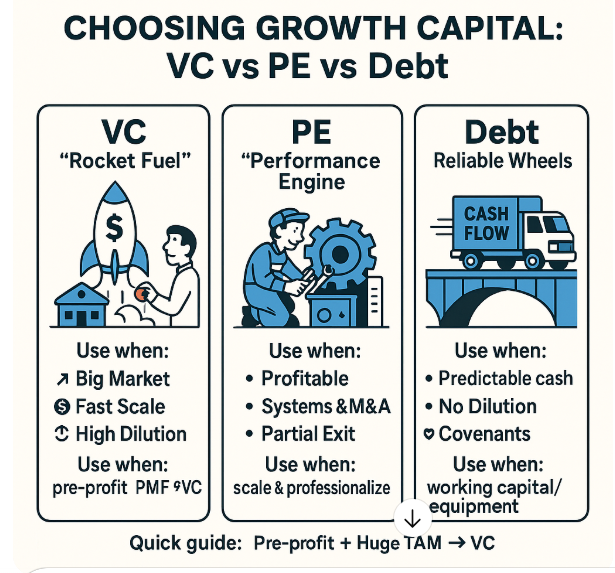

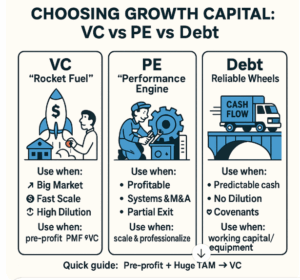

Raising capital isn’t just about “how much.” It’s about what kind of money fits your stage, your risk profile, and the control you want to keep. Three big buckets dominate growth financing: venture capital (VC), private equity (PE), and debt. Below is a practical guide to what each is, how to estimate your eligibility, what to expect as an owner, and when to use which.

Quick definitions

Venture Capital (VC). Equity investors backing high-growth, high-risk companies—often pre-profit. They buy a minority stake, expect rapid scale, and aim for outsized outcomes (think 10x). Typical for technology, biotech, network-effect platforms, and businesses with huge total addressable markets (TAM).

Private Equity (PE). Equity investors (control or minority) in mature, profitable companies. They often bring operational discipline, roll-up strategies, and professionalization. PE spans buyout funds (majority/control) and growth equity (minority with expansion capital).

Debt. Borrowed capital you must repay, usually with interest and covenants. This includes bank term loans, lines of credit, asset-based loans, SBA loans, venture debt, revenue-based financing, and equipment financing. Lowest cost of capital if cash flows are predictable.

How to estimate what you’re eligible for

VC eligibility (traction + story).

VCs invest in trajectory. They look for credible evidence that your solution can become very large, very fast.

-

Stage heuristics:

-

Pre-seed/Seed: Compelling insight, prototype/MVP, early customer love.

-

Series A: Signs of product-market fit (e.g., B2B SaaS with ~$1–2M ARR and strong retention; consumer apps with meaningful DAU/MAU and cohort stickiness).

-

-

Market: Large and expanding TAM with a path to category leadership.

-

Economics: Improving unit economics (e.g., CAC payback < 18 months, positive contribution margins).

-

Raise size (rule of thumb): Target 18–24 months of runway: Raise = Monthly Net Burn × 18–24 (add a ~15–20% buffer). Expect 15–25% dilution per round in many cases.

PE eligibility (profit + repeatability).

PE invests in performance and predictability.

-

Scale: Many buyout funds look for EBITDA of $3–5M+; growth equity can go smaller if growth and quality are exceptional.

-

Quality of earnings: Stable gross margins, repeat/contracted revenue, diversified customers, clean books.

-

Use cases: Geographic expansion, new product lines, professionalizing operations, founder liquidity (partial exit), or buy-and-build roll-ups.

Debt eligibility (cash flow + collateral).

Lenders underwrite repayment capacity.

-

Coverage: A common test is DSCR (Debt Service Coverage Ratio) = EBITDA / (Principal + Interest). Many banks want DSCR ≥ 1.25x.

-

Leverage: Total Debt / EBITDA often needs to be ≤ ~3.0x for traditional banks (more can be possible with venture debt or strong collateral).

-

Asset-backed options: Accounts receivable, inventory, equipment, and subscription ARR can support borrowing bases. For recurring-revenue businesses, lines can be sized as a % of ARR, adjusted for retention and churn.

-

Personal guarantees: For smaller companies and SBA loans, expect them.

What to expect as the owner

With VC:

-

Governance: Board seats, protective provisions, information rights, and sometimes reserved matters that require investor consent.

-

Milestones: Expect aggressive growth targets and follow-on round planning.

-

Economics: You’re selling equity—dilution is real—but upside can be significant if the company becomes a market leader. Liquidation preferences sit ahead of common stock.

With PE:

-

Control and cadence: In buyouts, expect majority control to shift and a rigorous 100-day plan. In growth equity, you can keep control but adopt tighter reporting and KPI discipline.

-

Professionalization: Operating partners, M&A playbooks, pricing projects, CFO upgrades—helpful if you welcome structure.

-

Liquidity: Founders often de-risk by selling a portion now, then a “second bite of the apple” at exit.

With Debt:

-

Control preserved: No dilution if you stay within covenants.

-

Constraints: Covenants, monthly reporting, borrowing base audits, and potential cash sweeps.

-

Risk: If growth stalls and coverage weakens, debt can become a constraint at the worst time.

When to apply which one

Choose VC when…

You’re pre-profit (or lightly profitable) with a product that could dominate a huge market. Your chief risk is speed: scaling R&D, go-to-market, and hiring before competitors catch up. You need partners comfortable with uncertainty and rapid iteration.

Choose PE when…

You’re profitable with repeatable revenue and meaningful EBITDA, and you want to scale via acquisitions, enter new markets, or professionalize operations. You might also be seeking partial liquidity without stopping growth.

Choose Debt when…

You have predictable cash flows and line-of-sight to repayment. Use it for working capital, inventory, equipment, bridging to a milestone, or financing M&A alongside equity. For VC-backed startups, venture debt can extend runway after an equity round with modest dilution (via warrants).

Sizing the raise (fast math)

Debt sizing (cash-flow lending):

-

Estimate next 12 months EBITDA.

-

Assume a DSCR target (e.g., 1.25x).

-

Back into maximum annual debt service: Max Debt Service ≈ EBITDA / 1.25.

-

From current interest rates and amortization, estimate the principal you can support.

-

Cross-check Total Debt / EBITDA stays in a safe range for your lender.

Equity sizing (VC & PE growth rounds):

-

Runway method (VC): 18–24 months of net burn + buffer.

-

Milestone method: Raise the amount required to prove the next valuation-moving milestone (e.g., $5M ARR, FDA progress, 3 profitable locations), not everything you’ll ever need.

-

PE co-investment: In buyouts, debt might cover 40–60% of enterprise value, with equity covering the rest. Founders decide how much equity to roll (stay invested) vs. cash out—balance control, risk, and upside.

Getting your house ready

-

Financial hygiene: GAAP P&L, balance sheet, and cash flow; monthly closes; forecast and variance analysis.

-

Unit economics: CAC, LTV, payback, cohort retention, gross margin by product/segment.

-

Revenue quality: Contracts, churn, concentration, and pipeline quality (for B2B).

-

Legal/IP: Cap table, employee/IP assignments, major agreements, compliance.

-

KPIs dashboard: A single source of truth you can share confidently.

A simple decision checklist

-

Goal: Scale fast, professionalize/roll up, or smooth cash cycles?

-

Profitability today: Negative (VC likely), modest (VC or venture debt), strong and stable (PE or bank debt).

-

Risk tolerance: Comfortable with dilution and board oversight (VC/PE) vs. prefer control with covenants (debt).

-

Use of proceeds: R&D and market capture (VC), acquisitions and ops upgrades (PE), working capital/equipment (debt).

-

Metrics: Do you clear the bar—PMF and growth (VC), EBITDA quality (PE), DSCR and leverage (debt)?

-

Owner objectives: Keep control, take chips off the table, or swing for market leadership?

What to expect in the process

-

VC: Narrative plus numbers. You’ll pitch vision, team, market, traction, and why now. Diligence focuses on growth indicators and the path to category leadership.

-

PE: Deeper operational diligence—quality of earnings, customer interviews, market studies, org design. Expect a structured value-creation plan.

-

Debt: Financial packages, forecasts, collateral schedules, and covenant modeling. Underwriting wants evidence you can service debt in downside scenarios.

Putting it all together

Think of capital as tools, not trophies. VC is rocket fuel for companies chasing category leadership in huge markets. PE is a performance accelerator and, for many founders, a way to professionalize and de-risk while still growing. Debt is the efficient workhorse that preserves ownership when cash flows are dependable. Many healthy companies use a blend: equity for uncertainty and step-changes; debt for predictable, ROI-positive spend.

Start by scoring yourself honestly on market size, momentum, and cash-flow predictability. Build a tight model, compute DSCR and leverage, and pressure-test your plan. Then choose the financing that matches your next milestone—not the one that flatters your ego. The right capital, at the right time, with clear eyes about trade-offs, is how you grow without losing the company you set out to build.

[ Dr Pal is connected to many investors and finances- if you want to take a chance- please email him – bpal@robolytics.ai/biplabpal2000@gmail.com-he can do a quick evaluation of your business and suggest path forward ]